We put data at the heart of your decision making processes.

We put data at the heart of your decision making processes.

All your data, one-stop service

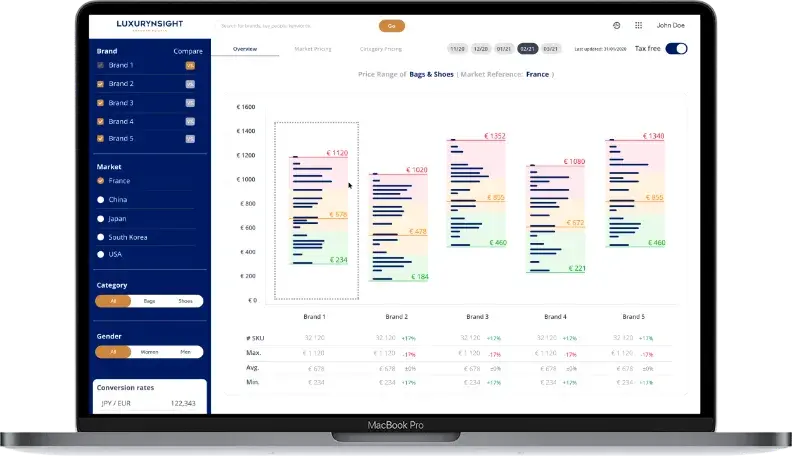

Including live currency exchange and tax

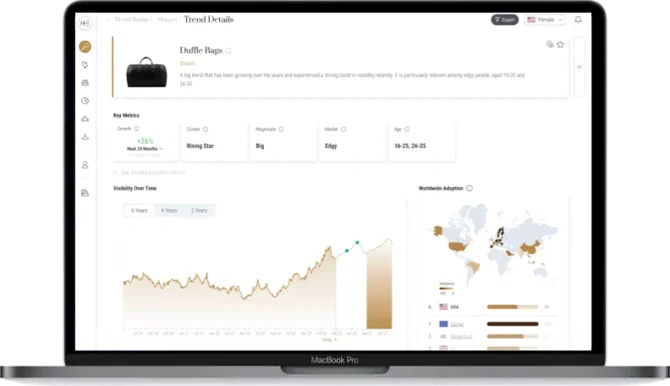

24-month AI prediction on 2.000+ fashion attributes with 91% accuracy

Monitor 500k stores worldwide in real-time

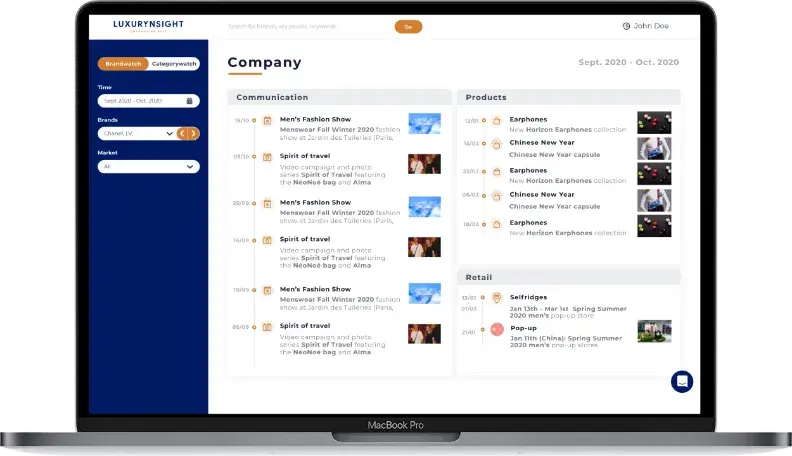

Monitor all new products, communication and distribution activations

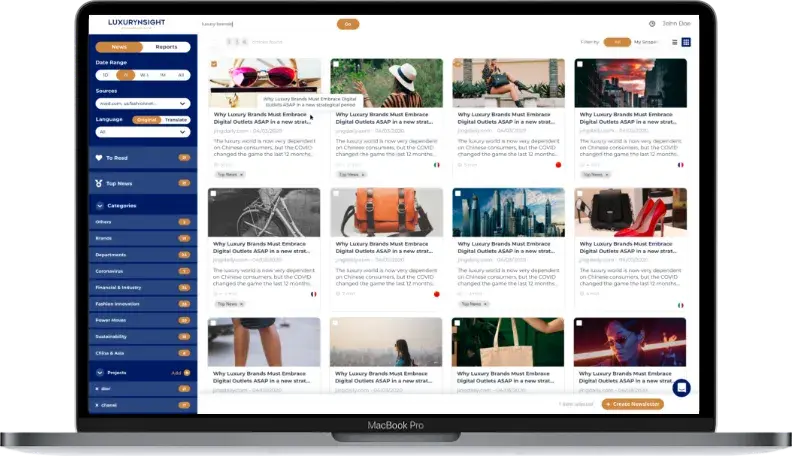

News & reports from 2000+ sources

Diverse industry expertise

International Team

From design studios to trend forecasting, AI is reshaping fashion. Heuritech explains how data-driven insights help brands anticipate demand without replacing creativity.

From poetcore to slim silhouettes and bold colors, Heuritech reveals the key menswear trends shaping Fall/Winter 2026.

Discover how Louis Vuitton is redefining luxury retail through retailtainment, immersive formats, and culture-led flagships in this Luxurynsight case study.

Luxurynsight's Team attended NRF Retail’s Big Show 2026 in New York, showcasing how data and AI help retail, luxury and fashion brands anticipate demand and drive smarter decisions.

What will drive fashion demand in 2026? Heuritech reveals the key pieces, materials and prints shaping consumer behavior throughout the year.

Luxury brands expand into mass-market sports despite a renewed focus on exclusivity. Jonathan Siboni of Luxurynsight explains why sports remain a key growth lever.

Luxury brands in China are prioritising immersive experiences over products to engage younger consumers. Jonathan Siboni of Luxurynsight explains the strategy.

Luxurynsight’s latest report—featured in Fashion Network—shows fashion retail initiatives slowing in early 2025, while beauty, fragrances and cosmetics record strong growth. Explore global activation trends across major luxury brands and key regions including China, Europe, APAC and MENA.

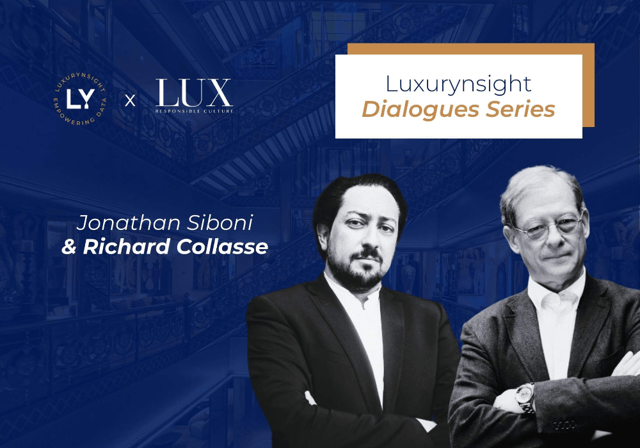

Explore the latest Luxurynsight Dialogues as CEO Jonathan Siboni interviews Richard Collasse, former President of Chanel K.K., in a LUX Magazine feature. Their conversation uncovers Japan’s unique luxury landscape, the evolution of craftsmanship, and the cultural forces shaping the future of global luxury.

Discover why pink is sparking political debate yet gaining momentum in menswear. This 2025 analysis reveals designer perspectives, market trends, and expert insights on the color’s cultural and commercial power.

Luxurynsight participated in the Tech for Retail 2025, Booth #B46, to explore how data and AI are shaping the future of retail and luxury.

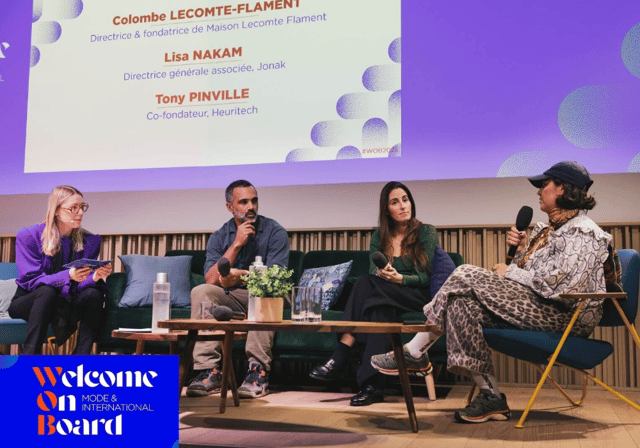

Event recap: At Welcome On Board 2025, Heuritech Co-founder Tony Pinville shared expert perspectives on the pivotal role of AI and data in accelerating export performance, alongside 250+ leaders from the fashion and retail industries.